ETH Price Prediction: Path to $5,000 Clears as Technical and Fundamental Factors Align

#ETH

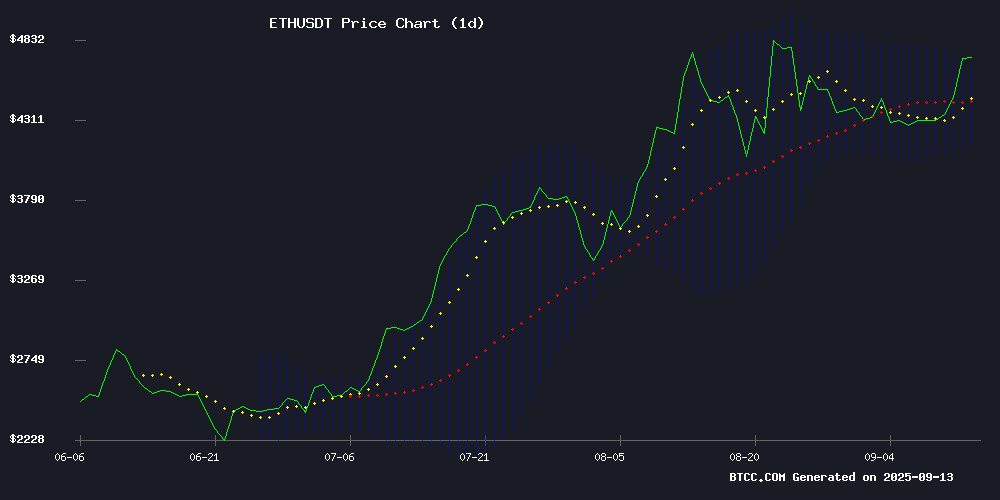

- Technical indicators show ETH testing upper Bollinger Band resistance with strong moving average support

- Fundamental factors include record-low exchange supply and $342M institutional accumulation

- Market sentiment remains bullish with reduced selling pressure and positive news flow supporting $5,000 target

ETH Price Prediction

Technical Analysis: ETH Approaches Key Resistance

ETH is currently trading at $4,639.99, testing the upper Bollinger Band at $4,654.64. The 20-day moving average at $4,408.65 provides solid support, while the MACD shows bullish momentum despite a slight negative histogram. According to BTCC financial analyst William, 'The convergence of price NEAR the upper Bollinger Band suggests potential for a breakout if buying pressure sustains above $4,650.'

Market Sentiment: Bullish Fundamentals Support Rally

Positive news FLOW surrounds Ethereum, with exchange supply hitting yearly lows and institutional accumulation totaling $342 million ahead of key economic events. BTCC financial analyst William notes, 'Reduced selling pressure combined with strong institutional interest creates favorable conditions for ETH to test higher levels. The $5,000 psychological barrier appears increasingly achievable given current momentum.'

Factors Influencing ETH's Price

Ethereum’s Path to $5,000 Clears as Exchange Supply Hits Year-to-Date Low

Ethereum's price surge aligns with a resurgence in broader crypto market risk appetite, fueling speculation of an imminent breakout toward $5,000. The Ethereum Exchange Supply Ratio (ESR) has plummeted to 0.14, its lowest level this year, signaling reduced selling pressure as holders move coins off centralized platforms.

Institutional confidence appears to be recovering, with spot ethereum ETFs witnessing renewed inflows after recent outflows. Historical patterns suggest such supply contractions often precede sustained rallies, strengthening the case for ETH's upward trajectory.

Ethereum Price Analysis: Is $5K Inevitable as ETH Finally Breaks Out?

Ethereum has surged past weeks of consolidation, rallying decisively into a critical resistance zone between $4.7K and $4.8K. The asset's breakout from a wedge formation on the 4-hour chart signals bullish momentum, though supply pressures loom at current levels.

A daily close above $4.8K WOULD open the path to $5K, reinforcing the ascending channel pattern that has guided ETH's uptrend. Rejection here, however, could see a retracement toward $4.4K support—a pivotal area where buyers must defend the breakout's validity.

Market structure now hinges on whether ETH absorbs selling pressure at this technical inflection point. The $5K psychological barrier remains within reach, but not without first conquering overhead supply.

Ether Faces Crucial Test at $5.2K Price Zone Amid Institutional Accumulation

Ethereum's market structure shows unusual strength as institutional holdings nearly double since April 2025, now representing 6.5-6.7 million ETH. On-chain activity reaches record levels while selling pressure diminishes—a rare convergence of fundamentals that could propel prices toward the $5,200 realized-price threshold.

Analysts highlight 'dual momentum' from both capital inflows and network utility. The growing ETF custody balance suggests longer-term positioning rather than speculative trading. Ethereum's supply dynamics appear increasingly constrained just as transaction volumes across DeFi and LAYER 2 solutions hit new highs.

Vitalik Buterin at EthTokyo 2025: Ethereum's Path Forward and Global Collaboration

Ethereum co-founder Vitalik Buterin delivered a keynote at EthTokyo 2025, emphasizing Asia's pivotal role in Ethereum's early growth and outlining ambitious scaling targets. Buterin called for renewed global collaboration to advance the blockchain ecosystem.

The speech highlighted a bold 10x scaling goal for Ethereum, underscoring the network's commitment to overcoming technical barriers. Buterin's remarks traced Ethereum's origins, noting how Asian communities contributed to its rapid adoption and innovation.

Kame Aggregator Recovers 185 ETH Following Hack Negotiations

Kame Aggregator, a trading platform built on the SEI blockchain, suffered a security breach earlier today. The incident resulted in the theft of an undisclosed amount of cryptocurrency, with Ethereum (ETH) being the primary asset affected.

In a swift response, the platform's team engaged in negotiations with the attacker, successfully recovering 185 ETH. While the full extent of the breach remains unclear, this partial recovery demonstrates the growing sophistication of crisis management in decentralized finance.

Vitalik Buterin’s Take on AI Governance: Human Oversight Is Key

Ethereum co-founder Vitalik Buterin has raised concerns about the rising trend of "AI governance" in a recent social media post. He cautioned against simplistic approaches to managing such systems, warning of potential unintended consequences.

Buterin's comments highlight the growing intersection between blockchain technology and artificial intelligence. As a leading voice in the crypto space, his perspectives often signal emerging themes that could shape future developments in decentralized systems.

Ethereum Whale Nets $73M Profit After Three-Year Staking Strategy

A shrewd Ethereum investor has capitalized on a disciplined accumulation and staking strategy, realizing $73 million in profits after three years of strategic positioning. Wallet 0xdE03 sold 25,755 ETH ($117 million) in its latest transaction, marking the culmination of a calculated approach that began with withdrawals at an average price of $2,411 per token.

The whale methodically staked 44,661 ETH ($107.7 million) during accumulation, then deposited 45,132 ETH ($165.5 million) to Binance at $3,668 per ETH as prices rallied. This represents a 52% appreciation from initial positions. The entity retains 3,362 ETH ($15.2 million) in reserve, demonstrating continued conviction in Ethereum's value proposition.

Exchange FLOW data from Arkham Intelligence reveals a pattern of deliberate capital deployment, with Binance serving as the primary liquidity venue. The three-year holding period underscores growing institutional sophistication in crypto asset management, where staking rewards compound strategic positioning during market cycles.

WisdomTree Launches Tokenized Private Credit Fund on Ethereum and Stellar

WisdomTree has unveiled its tokenized private credit fund, marking a significant step in the convergence of traditional finance and blockchain technology. The WisdomTree Private Credit and Alternative Income Digital Fund (CRDYX) tracks the Gapstow Private Credit and Alternative Income Index (GLACI), offering exposure to 35 publicly traded private credit vehicles.

The fund will be tokenized on both Ethereum and stellar blockchains, enabling investors to access private credit markets with a minimum investment of $25 through WisdomTree's Prime and Connect platforms. This move democratizes access to an asset class traditionally reserved for institutional players.

By leveraging blockchain infrastructure, WisdomTree aims to combine the regulatory compliance of traditional finance with the efficiency and accessibility of digital assets. The GLACI index employs a rules-based, equal-weighted approach to track performance across the private credit sector.

Ethereum Breaks $4,500 Amid Strong Accumulation and Reduced Selling Pressure

Ethereum surged past the $4,500 resistance level, trading at $4,650 as investor accumulation and declining selling pressure fuel bullish momentum. Over 1.7 million ETH has been accumulated in the $4,300-$4,400 range, signaling strong support and potential for further gains.

Exchange outflows dominate recent activity, with withdrawals processed at an average cost basis of $4,300. This level now serves as a critical support zone, with heightened sensitivity to maintaining the $4,300-$4,400 range. The accumulation establishes it as a focal point for market participants.

Despite one of its strongest cycles, ETH must clear the upper band realized price to sustain another bullish run. The cryptocurrency now eyes a move toward its all-time high, backed by robust demand and constrained supply.

Mysterious Wallets Accumulate $342M in ETH Ahead of U.S. Rate Decision

Four newly created wallets withdrew 78,229 ETH ($342 million) from Kraken within 10 hours, signaling potential institutional accumulation. The timing coincides with a technical breakout from a three-week descending channel and precedes next week's anticipated Federal Reserve rate cuts—a macro catalyst historically favorable for risk assets.

Lookonchain data confirms the transactions lack ties to known whales, fueling speculation of covert billionaire positioning. Exchange outflows of this magnitude typically indicate long-term holding strategies, as smart money shifts assets to self-custody. Ethereum's price chart shows the accumulation occurred hours before breaching a critical resistance level anchored by an August support trendline.

Ethereum Price Surges Past $4,500 – Key Levels to Watch for More Gains

Ethereum's price has broken through the $4,500 barrier, signaling a strong bullish momentum. The cryptocurrency is now consolidating, with traders eyeing a potential push beyond $4,550 to confirm further upside.

A bullish trend line has emerged on the hourly ETH/USD chart, anchored by support at $4,470. The asset remains firmly above the 100-hourly Simple Moving Average, reinforcing the positive sentiment. Resistance levels at $4,530 and $4,580 loom as critical thresholds; a decisive breach could propel ETH toward $4,650.

The recovery wave began after Ethereum established a solid base above $4,320, mirroring Bitcoin's trajectory. The 23.6% Fibonacci retracement level from the recent swing low to high has held, underscoring the market's resilience.

Will ETH Price Hit 5000?

Based on current technical indicators and market sentiment, ETH has a strong probability of reaching $5,000. The price is currently testing key resistance at the upper Bollinger Band ($4,654.64) while maintaining support above the 20-day MA ($4,408.65). Combined with reduced exchange supply and significant institutional accumulation, these factors create favorable conditions for upward movement.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $4,639.99 | Testing Resistance |

| 20-day MA | $4,408.65 | Support |

| Upper Bollinger | $4,654.64 | Key Resistance |

| MACD | 79.03 | Bullish |